Revised Medium-Term Management Plan

Meanwhile, in response to the financial results during the fiscal year ended March 2023 falling short of the plan by considerable margin, our group reviewed the medium-term management plan (referred to as “the revised medium-term management plan” hereinbelow) which was disclosed in November 2023. Under the revised medium-term management plan, we will implement “business model reforms to improve profitability,” “growth strategy to achieve VISION2030,” “introduction of ROIC management” and “promotion of asset reduction” to make progress in re-developing supply chain management and strengthening our management platform, in order to improve profitability and capital efficiency and enhance the effectiveness of our strategy. We will also seek to evolve into Wacoal Group that is capable of offering products and services that can contribute to customers’ individuality on a continuing basis, by supporting our employees’ taking on challenges and their growth.

Basic Policy of the Revised Medium-Term Management Plan

In order to improve the probability of achieving VISION 2030, first we will shift to a structure that can steadily generate cash.

Through business model reforms and our growth strategy, we will strengthen our profitability and our ability to respond to customer changes while striving to improve capital efficiency.

Priority strategies of the Revised Medium-Term Management Plan

To work to improve and enhance profitability and capital efficiency, and evolve into a company that is capable of making necessary growth investment for sustainable enhancement of corporate value and continuing to provide returns to stakeholders

| Recognizing the Current Situation | The speed of changes in the external environment was quicker than expected, and weaknesses in our supply chain management have become apparent

|

|||

|---|---|---|---|---|

| Environmental Awareness | Opportunities

|

Risks

|

||

| Wacoal Group’s Strengths |  |

|

|

|

| Basic Policy |

Strive to improve and enhance profitability and capital efficiency and transform ourselves into a company that can continue to invest in the growth necessary to sustainably increase corporate value and return profits to our stakeholders.

1. Business model reforms to improve profitability

Implementing business model reforms (supply chain management reforms and cost structure reforms) to restore basic profitability

2. Growth strategy to achieve VISION 2030

Carrying out brand strategy and customer strategy, utilizing the power of digital resources and our Company’s strengths to lead to further growth

3. Introducing ROIC management

Introducing ROIC management as business management infrastructure that supports measures to enhance profitability and the effectiveness of strategies

4. Promoting asset reduction

Improving capital efficiency by reducing inventories, cross-shareholdings, and streamlining real estate holdings

|

|||

| Financial Strategy |

|

|||

Revised Medium-Term Management Plan Strategy

| (1) Business Model Reforms |

Supply chain management reform

Implementing SCM reforms at Wacoal (Japan) to respond quickly to changes in customer needs and the market environmentWith the use of digital technology to build SCM linked to demand from the customer’s point of view, thoroughly selecting and focusing to optimize the cost structure Cost structure reform

In order to restore Wacoal (Japan)’s basic profitability, a radical cost structure reform will be implemented. Setting reduction target to ¥7 billionWe plan to improve the sales profit ratio by 3 pts to 4 pts and SG&A expenses by 4 pts to 5 pts by FY2026 (compared to FY2023) Dealing with unprofitable businesses

Examine the future ideal state of each business and determine an action plan for the continuation, sale, or withdrawal of each business

|

|---|---|

| (2) Growth Strategy |

Wacoal Corp.

To meet diversifying customer needs, we will contribute to the “beauty, comfort, and health of each customer”

Overseas business

Amid an uncertain business environment, we will first work to improve our management infrastructure and execute growth strategies for the next medium-term management plan

|

| (3) Introducing ROIC Management |

Introducing ROIC management to improve capital efficiency and achieve a robust corporate structure

In addition to portfolio management, it is also used as a means of performance management to accurately measure results, and quantitatively link improvement activities on the ground with improvements in profitability and capital efficiency expected by investors and other stakeholders

|

| (4) Promoting Asset Reduction |

In order to improve asset and capital efficiency, the Company’s basic policy is to sell any assets that do not contribute to raising corporate value

When selling, we will search for investment opportunities that will contribute to business growth, and determine the businesses that should be invested in from the perspective of ROIC (Inventories, cross-shareholdings, and real estate holdings are subject to review and implementation)

|

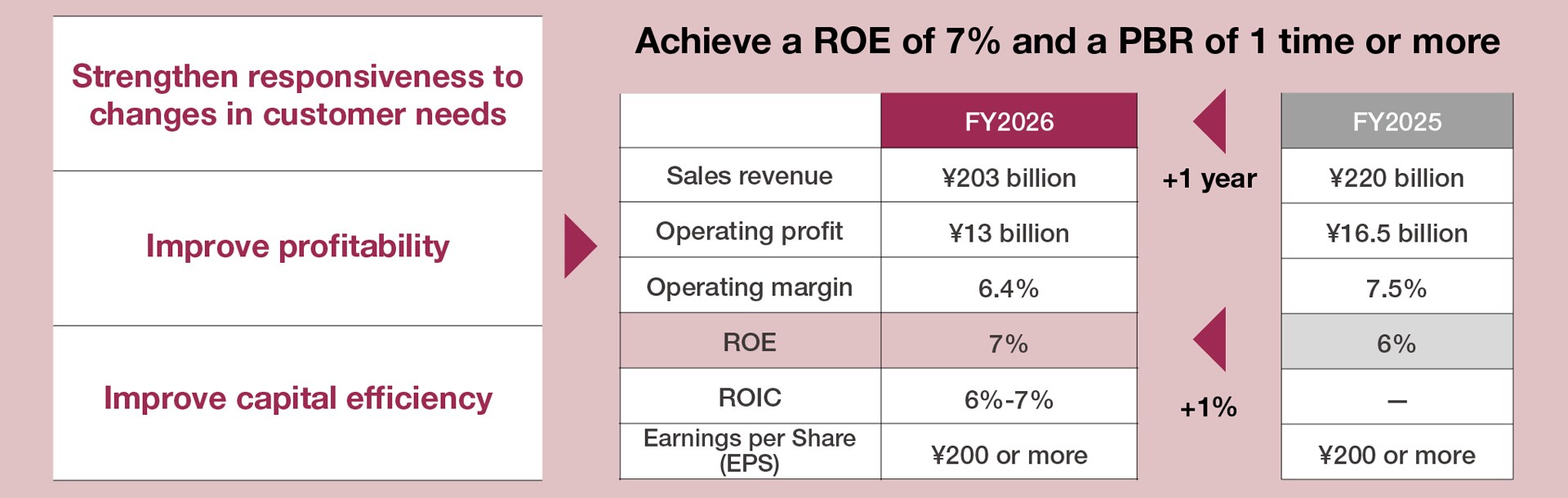

Quantitative Targets in the Revised Medium-Term Management Plan

The revised medium-term management plan aims to achieve ROE of 7% and PBR of 1 time or more in March 2026, its final year, by striving to improve capital efficiency while working to strengthen our responsiveness to changes in customer needs and our profitability through the execution of business model reforms and a growth strategy.

Our group has decided to introduce ROIC management to improve capital efficiency and realize robust corporate structure. We will use it not only for managing enterprise-wide financial targets, but also as a means of performance management to accurately measure results and quantitatively link improvement activities on the ground with improvements in profitability and capital efficiency expected by investors and other stakeholders.

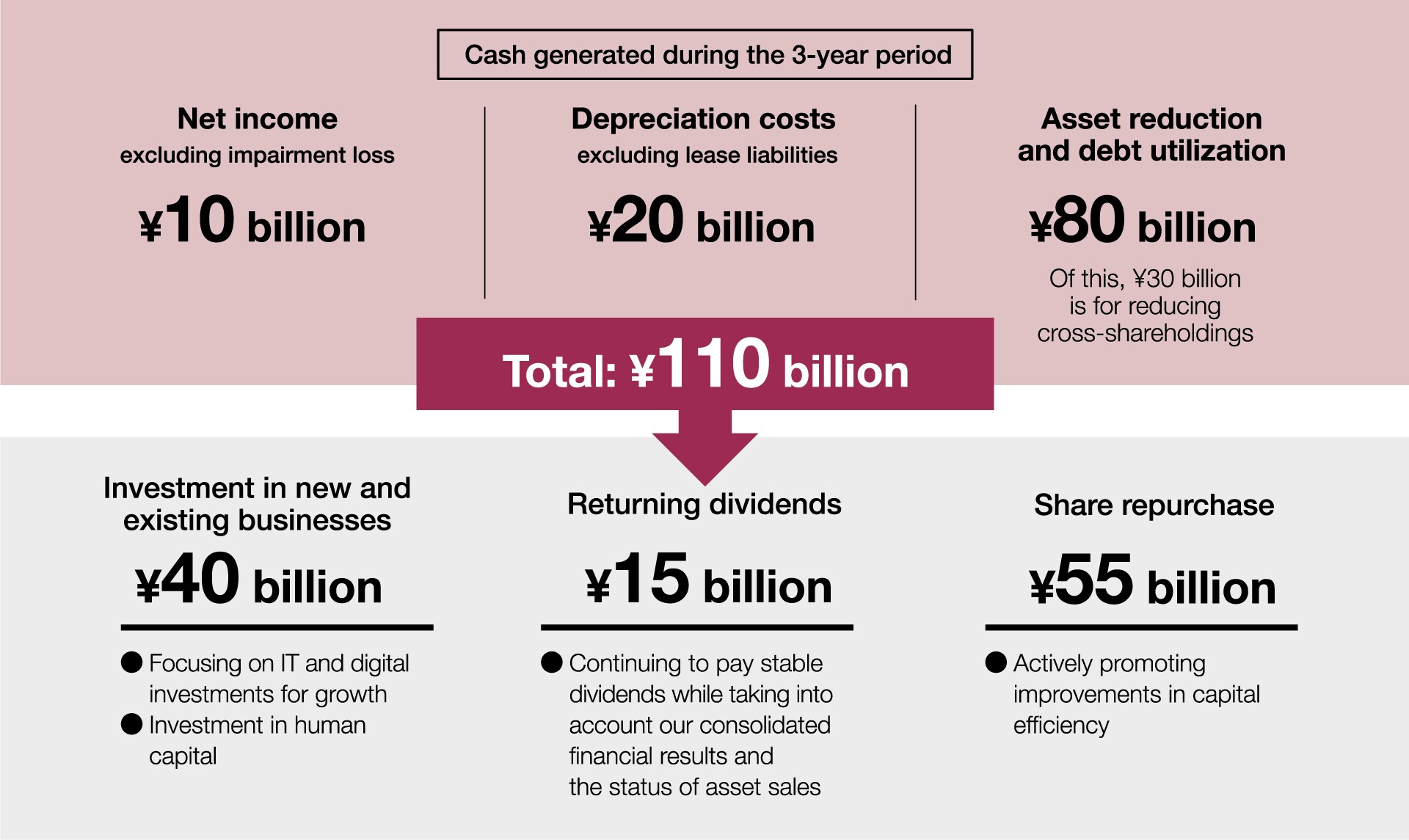

Financial Strategy

Financial Policies:

- Improving profitability through business model reforms and growth strategies as a top priority, we will reduce inventories and cross-shareholdings, and streamline real estate holdings to improve capital efficiency and ROE

- While prioritizing investments for future growth, we will actively return profits to shareholders to improve capital efficiency

Dividend Policy:

Our basic policy on profit distribution to shareholders is to make stable distributions based on consideration of our consolidated performance, while seeking to increase our enterprise value through active investment aimed at higher profitability and to increase net income per share.

Cash Flow Allocation(FY2024~FY2026):

during the medium-term plan revision period, we will strive to improve profitability through structural reforms, reduce inventories andcross-shareholdings, and liquidate real estate holdings.The policy is to actively return the cash generated thereby to shareholders in order to improve capital efficiency, while giving priority to investment in growth. We will work to achieve our ROE and ROIC targets through both business and financial strategies.

Positioning of the revised medium-term management plan in “VISION2030”

The period of the revised medium-term management plan is viewed as a reform period to achieve “VISION2030,” and we plan to improve profitability and capital efficiency by steadily implementing various measures according to the plan. Further, the next medium-term management plan period and beyond are considered as a “foundation and growth period.” We will reap the results of reforms to be implemented under the revised medium-term management plan, and actively make investment for the next stage of growth. We will increase the probability of achieving the “VISION2030” targets by improving the effectiveness of management through the implementation of the revised medium-term management plan.