Dividend and Share Repurchase

Basic policy

Our basic policy on profit distribution to shareholders is to make stable distributions based on consideration of our consolidated performance, while seeking to increase our enterprise value through active investment aimed at higher profitability and to increase net income per share.

Dividend information

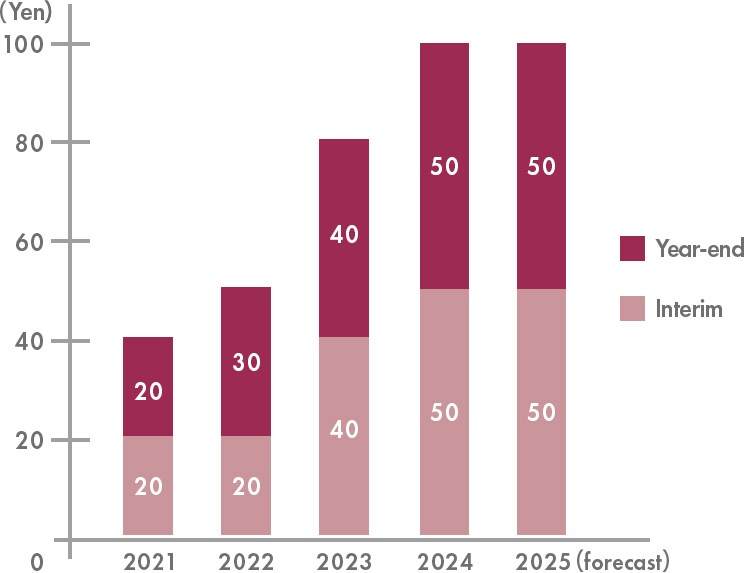

Our basic policy is to distribute earnings twice a year in the form of interim and year-end dividends and the Board of Directors is the decision-making body for distribution of earnings.

Regarding the annual dividend for the fiscal year ending March 2024, we plan to pay an interim dividend of 50 yen per share, a year-end dividend of 50 yen per share, and an annual dividend of 100 yen.

Fixed Date of Dividend Payout and Starting Date of Payout

| Interim dividend | Year-end Dividend | |

|---|---|---|

| Record date | September 30 | March 31 |

| Payable date | December | June |

Cash Dividends per Share (yen)

Share Repurchase

| Repurchase period | Method of acquisition | Total number of shares repurchased | Total amount |

|---|---|---|---|

| From June 4, 2022 through March 24, 2023 |

Market purchase ToSTNeT-3 |

3,498,900 shares | 8,033,937,600 yen |

| From December 1, 2021 through Feburuary 17, 2022 |

Market purchase ToSTNeT-3 |

1,000,000 shares | 2,088,056,600 yen |

| From February 3, 2020 through March 26, 2020 |

Market purchase ToSTNeT-3 |

969,500 shares | 2,743,744,700 yen |

| From May 16, 2019 through December 31, 2019 |

Market purchase ToSTNeT-3 |

1,828,000 shares | 4,999,832,200 yen |

| From May 21, 2018 through December 31, 2018 |

Market purchase ToSTNeT-3 |

2,200,000 shares | 6,918,217,200 yen |

| From May 15, 2017 through December 31, 2017 |

Market purchase | 1,240,700 shares | 3,998,101,500 yen |

*The Company conducted a share consolidation of its common stock pursuant to which two shares were consolidated into one share effective as of October 1, 2017. However, this effect has not been taken into account.